Threat actors targeting the banking and finance industry

Threat actors targeting the banking and finance industry typically have a range of motivations, including financial gain, espionage, and disruption. Here are the key focuses of these actors:

1. Financial Theft and Fraud

- Motivation: Direct monetary gain.

- Techniques:

- Phishing and Spear Phishing: Harvesting customer credentials or employee access.

- Credential Skimming: ATM skimmers and point-of-sale (POS) malware.

- Account Takeover (ATO): Using stolen credentials to drain accounts or commit fraud.

- Business Email Compromise (BEC): Deceiving employees to approve fraudulent transactions.

2. Ransomware Attacks

- Motivation: Extortion for ransom payments.

- Techniques:

- Encrypting critical data and systems, paralyzing operations.

- Double extortion: Threatening to leak sensitive customer data.

- Targeting backups to ensure ransom payment.

3. Insider Threats

- Motivation: Malicious or inadvertent actions by employees.

- Techniques:

- Misuse of privileged access to steal data or transfer funds.

- Collusion with external cybercriminals.

- Mistakes leading to data breaches (e.g., phishing clicks or poor cybersecurity hygiene).

4. Supply Chain Attacks

- Motivation: Exploiting third-party vulnerabilities to compromise banks indirectly.

- Techniques:

- Targeting fintech partners or vendors.

- Injecting malware into software updates or services.

- Exploiting cloud misconfigurations.

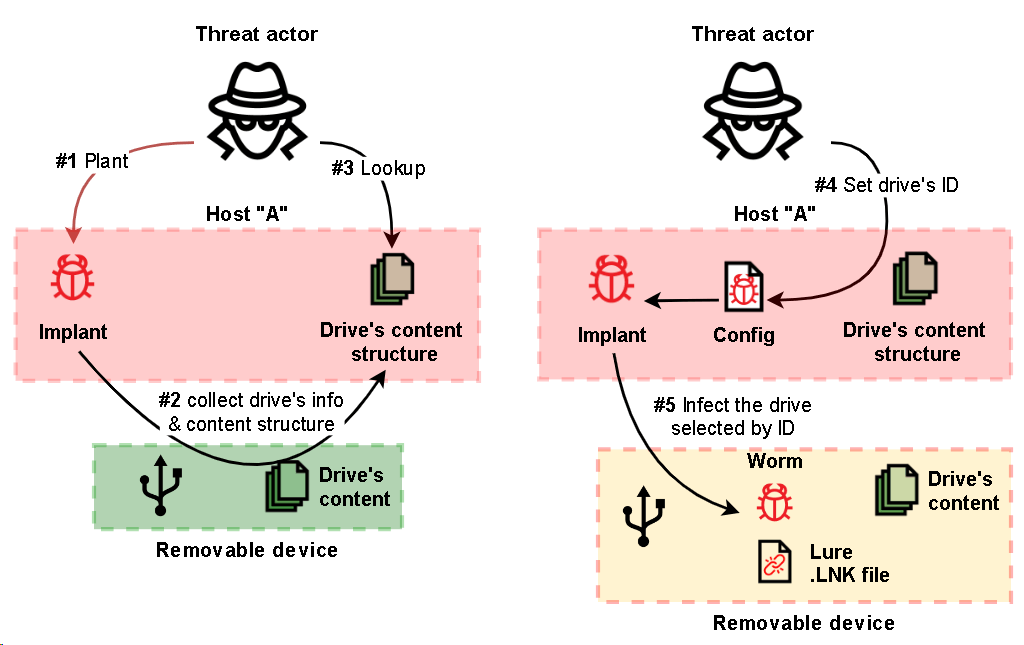

5. Advanced Persistent Threats (APTs)

- Motivation: Espionage or geopolitical disruption.

- Techniques:

- Nation-state actors infiltrating systems for sensitive data.

- Long-term infiltration with undetected lateral movement.

- Zero-day vulnerabilities and sophisticated exploits.

6. Distributed Denial-of-Service (DDoS) Attacks

- Motivation: Disruption of operations or diversion for other attacks.

- Techniques:

- Overwhelming online banking portals or financial services.

- Using botnets to flood servers and degrade performance.

7. Cryptojacking

- Motivation: Using banking systems to mine cryptocurrencies.

- Techniques:

- Injecting malware to hijack computing resources.

- Targeting internal servers, cloud systems, or customer devices.

8. Data Breaches and Theft

- Motivation: Stealing personally identifiable information (PII) for resale or identity theft.

- Techniques:

- Exploiting vulnerabilities in customer databases.

- Unprotected APIs or insecure mobile banking apps.

- Targeting backups for sensitive data.

9. Emerging Threats (AI and Blockchain Exploits)

- Motivation: Capitalizing on emerging technologies.

- Techniques:

- AI-powered phishing or fraud attempts.

- Exploiting blockchain vulnerabilities in cryptocurrency transactions or smart contracts.

- Deepfakes for BEC or identity theft.

Notable Threat Actor Groups

- FIN7 (Carbanak Group): Specialized in ATM attacks and card fraud.

- Lazarus Group: North Korean APT targeting cryptocurrency and financial institutions.

- Cobalt Group: Focused on ATM jackpotting and SWIFT system attacks.

- TA505: Known for large-scale phishing campaigns and ransomware targeting financial organizations.

Mitigation Strategies

- Zero Trust Architecture: Limiting lateral movement and access to critical systems.

- Multi-Factor Authentication (MFA): Reducing credential compromise risks.

- Threat Intelligence Sharing: Collaborating with industry groups (e.g., FS-ISAC).

- Continuous Monitoring: Detecting anomalous behavior in real-time.

- Employee Training: Addressing phishing and social engineering awareness.